Coronavirus and Real Estate - Top 5 questions answered

I'm being asked a lot of questions about the Shelter In Place (SIP) directive and how it's affecting real estate here in the San Francisco Bay Area. Here are the answers to the top 5 questions I’m receiving.

1- Are houses still selling?

First some context: Our Multiple Listing Service (MLS) has stopped allowing agents to post broker tours and open houses. It has also frozen the “days on market” counting function so that sellers aren’t taking a hit because we are sheltering in place. That said, there are homes coming on the market every day, and yes, sellers are still selling and buyers are still buying. If you can wait, and shelter in place, then do so. It’s the right thing to do to flatten the curve. If you’re thinking of buying or selling in the first few months after this hold is lifted, we should strategize now so you’re ready when the market comes back – and yes, I believe it will come back and get busy, when this is lifted. Why do I think that? More on that, below.

2- How can property change hands if government offices are shut down, notaries can’t come out, appraisers can’t assess homes, etc? What about lenders?

Santa Clara and San Mateo Counties were closed for a few days at the beginning of SIP. That meant escrows weren’t being recorded because the County Recorders’ offices were closed. They have overcome that issue with an electronic closing process. This is new, and it means they are no longer the bottleneck.

A step before that in the process, loans weren’t being funded because notaries couldn’t get signatures, and loan officers couldn’t get into their systems. That’s all been addressed. There is now much more electronic signing than was previously allowed. There is still a requirement for a few forms to be notarized, and that’s in the process of being addressed as well.

As for appraisers, some lenders are no longer requiring physical appraisals. Instead photos/videos are being submitted.

3- I really need to sell/buy now because of what’s happening in my job/family. Is it possible?

Yes. It depends on your circumstances. There are properties selling both on and off market with regularity right now. We agents are doing live video tours of properties using apps like Zoom or FaceTime. Buyers are writing offers with contingencies to do a physical walk through after acceptance. I received one just this morning. Will this work in every situation? Of course not. I am advising my clients with health concerns NOT to show their occupied property now. Don’t risk your family’s health. It’s just not worth it. What if the home is vacant? Land and lots? Buyers are still visiting them. If you have an urgent need, call me. We’ll can discuss the best way to help you through a transition.

4- How’s the market?

Just like there are micro-climates up and down the Peninsula and South Bay, there are micro-markets, and there are many: condominium high rises with amenities on the ground floor, properties walking distance to tech companies or dinner in town, single family homes in the mountains, luxury homes… Saratoga is not Sunnyvale, and it is not San Francisco. I’m only going to address the basic trending here. For more specific information, please call me. I’m happy to share with you the market trends for your situation. Now is a great time to learn about the market you’re interested in so you can come out of the gate ready to go.

In general inventory is at historic lows – again. Some homes are selling in a matter of days. All cash is leading the pack in offers because there’s no possible delay from the lending side. On the flip side of that, some all-cash offers are extremely low, as investment buyers are betting that sellers are stuck and forced to sell. They’re learning that’s not the case. In other words, this market is very similar to other tight markets we’ve been in before. Supply still drives many of these local markets, but not all.

5- I’m hearing there’s a recession here/coming soon. Won’t that cause a problem with our local housing prices?

This is by far the biggest question I’m getting. As I always say, my crystal ball gets foggy at about 30-45 days into the future. I have some information from other industry leaders you may find helpful. As most of my clients know, I attend economic and real estate conferences to hear what others are predicting. Here’s some information I gleaned last week from a teleconference of several thousand high-producing agents across the country.

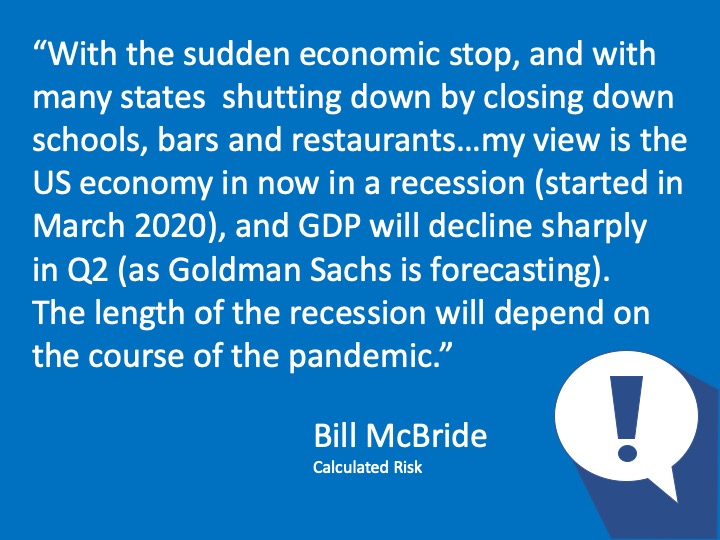

Everyone hears the word “recession” and thinks “Great Recession” of 2008. Let’s remember, that was a historic anomaly. Real estate is a market, just like stocks or bonds. It is cyclical. Times of growth and recession recur. The difference is the 2008 recession was caused by the housing crisis. The current economic issues causing this current situation are not related. They are of limited time span, and will also pass.

Let’s look at some trending. Yes, in 2008 housing prices nationwide fell. If you look at prior recessions, that is, remove the anomaly of 2008, during three of the last four recessions housing prices actually increased.

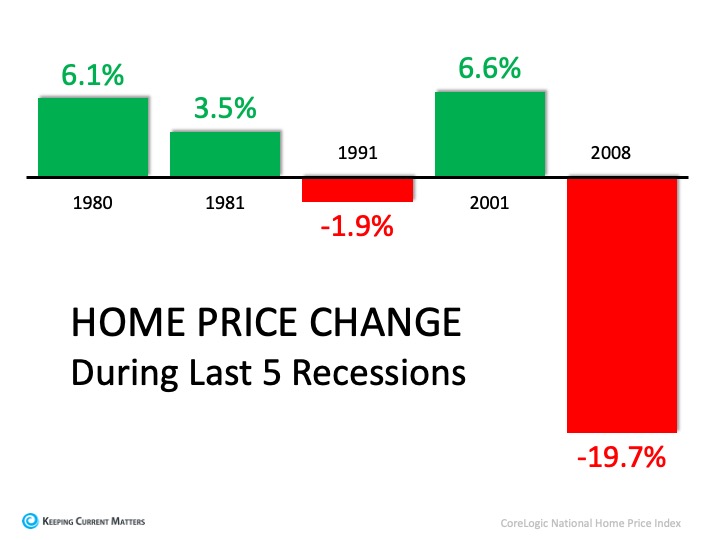

So assuming this is a recession, when will it end? When will people go back to work, when will the economy regain strength? Here’s one prediction:

The bigger question is going to be when will the virus be contained? That’s the current driving factor of the economic slowdown. Again, sheltering in place is the right thing to do.

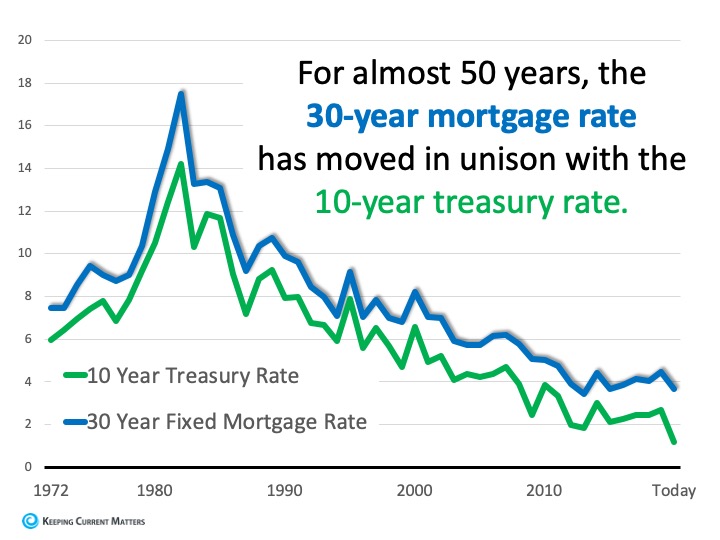

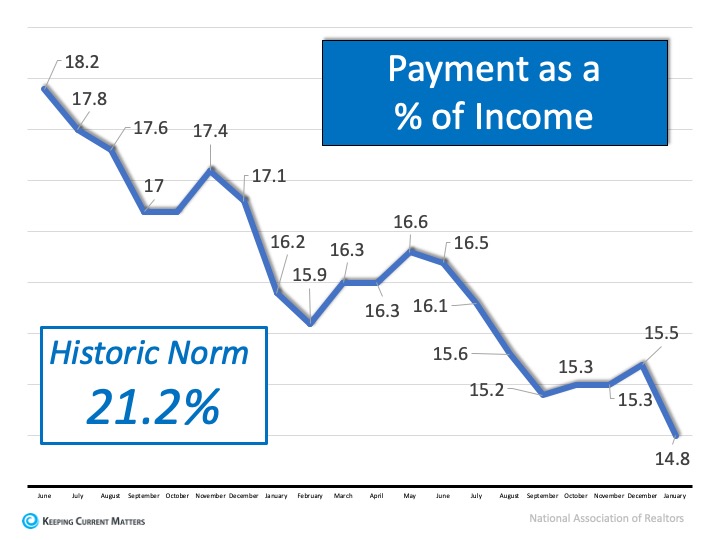

Let’s layer on some of the good news. Mortgage rates have been at historic lows. It is expected that they will drop again, after the virus passes. Why? The Fed dropped short term interest rates twice recently. You may know that short term rates are not directly tied to a 30-year mortgage. It’s meant more for short term loans, like home equity lines of credit (HELOC), or buying a car/boat, business loans, etc. However, it does influence what’s happening.

For every half a point decrease in interest rates, a buyer’s purchasing power increases 10%. That’s the portion of the monthly payment that is not going to interest on that half point, but is instead going towards principal. Buyers can afford more now than they could in the last few years.

In a normal annual cycle, transactions slow down over the winter holidays. Then by Spring, pent up demand is looking for supply, and sellers are readying their homes for the spring market. In the last few weeks, many local markets were starting to increase into a normal cycle. Then the virus hit. So, we are pausing. I fully expect to see sellers who had planned to sell come on the market when this pause ends. Buyers still have pent up demand. Everyone is still looking on line, either sellers at their competition, or buyers to see if the dream home hit the market.

It will return. Hang in there. Be kind to the people you’re living with, and look for ways to enjoy this unusual time.